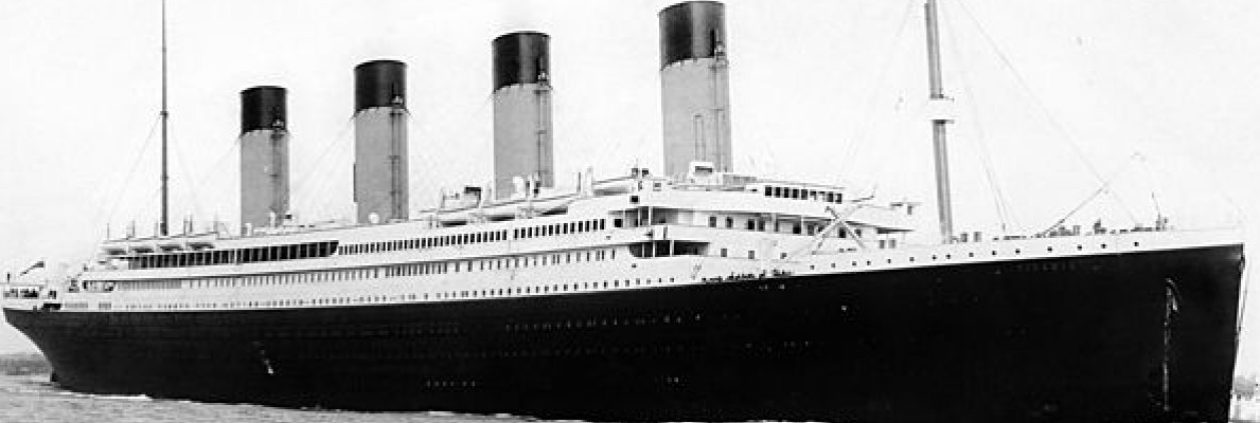

As most of you are aware, Premier Exhibitions filed for bankruptcy under Chapter 11 which allows it to reorganize. On Friday it was announced that the Premier Exhibitions Equity Committee had entered into an agreement that “will include the sale all of the Debtors’ assets, including the entire Titanic Artifacts Collection either as assets of the estate or through the sale of RMS Titanic Inc., the company that holds the Titanic Artifacts. The remaining Debtors and their assets likewise would be sold.”

As most of you are aware, Premier Exhibitions filed for bankruptcy under Chapter 11 which allows it to reorganize. On Friday it was announced that the Premier Exhibitions Equity Committee had entered into an agreement that “will include the sale all of the Debtors’ assets, including the entire Titanic Artifacts Collection either as assets of the estate or through the sale of RMS Titanic Inc., the company that holds the Titanic Artifacts. The remaining Debtors and their assets likewise would be sold.”

What it means is this: the company can be sold either whole or in parts depending upon the buyers interests. And the Titanic artifacts can be sold either as part of the sale of the whole company or through selling RMS Titanic Inc. The snag that has caused no sale on those artifacts under the salvage award is that they cannot be sold in lots or individually but as the one collection. And the price is simply too high. Under the present circumstances, the price might be lowered and also the possibility the bankruptcy judge might order it sold in lots in order to be sold. Before any of this can move forward, the judge has to agree to a disclosure statement.

Long ago when RMS Titanic Inc was made part of Premier (after some of the original founders of the company were removed and replaced) many thought it would lead to a better valued company. One wonders what really happened here. Titanic became very big after the movie and the centennial of the sinking. Belfast Titanic has done very well and makes money. Either the company was mismanaged and got way over their head or totally miscalculated how to monetize the assets (their exhibitions) to make a profit. Instead of Chapter 11, this is more like Chapter 13 now. The company’s assets are going to be sold in whole or in part to others now. The ghost of George Tulloch is laughing at those that brought this about.

Sources:

1. RMS Titanic, Inc., et al. (D/B/A PREMIER EXHIBITIONS)

2. Premier Exhibitions, operator of Titanic and Bodies shows, putting itself up for sale (Atlanta Business Chronicle, 21 May 2017)