With the shareholder approval on 29 Oct 2015, Premier Exhibitions has announced it has executed all the necessary agreements and that the merger is now complete. The Board Of Directors has appointed Daoping Bao as Executive Chairman Of The Board, President, and Chief Executive Officer of the company. The Board of Directors has increased to seven members and four new directors were appointed. Shareholders are hoping the new leadership will turn things around for Premier.

With the shareholder approval on 29 Oct 2015, Premier Exhibitions has announced it has executed all the necessary agreements and that the merger is now complete. The Board Of Directors has appointed Daoping Bao as Executive Chairman Of The Board, President, and Chief Executive Officer of the company. The Board of Directors has increased to seven members and four new directors were appointed. Shareholders are hoping the new leadership will turn things around for Premier.

Source: Premier Exhibitions, Inc. Announces Closing Of Merger With Dinoking Tech Inc. (Globe Newswire [Press Release],2 Nov 2015)

Category Archives: Premier Exhibitions

Premier Exhibitions Announces Shareholder Approval of Merger

The expected approval of the Dinoking merger with Premier Exhibitions took place on 29 Oct 2015. According to the press release, the merger transaction will take place in the next few days. Upon merger completion, Daoping Bao will be appointed the president and chief executive officer of the company. Some shareholders have expressed the hope that Bao will fix the problems caused by poor management of the company.

The expected approval of the Dinoking merger with Premier Exhibitions took place on 29 Oct 2015. According to the press release, the merger transaction will take place in the next few days. Upon merger completion, Daoping Bao will be appointed the president and chief executive officer of the company. Some shareholders have expressed the hope that Bao will fix the problems caused by poor management of the company.

Source: Premier Exhibitions, Inc. Announces Shareholder Approval of Merger With Dinoking Tech Inc (Globe Newswire-Press Release,30 Oct 2015)

Premier Exhibitions Announces Second Quarter Fiscal 2016 Earnings

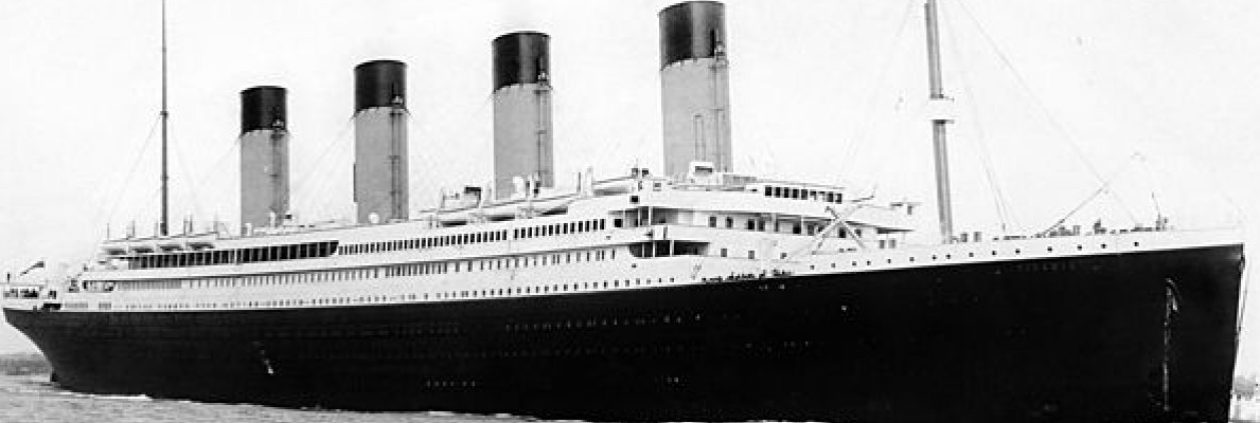

Premier Exhibitions, which owns RMS TItanic Inc and Titanic:The Artifact Exhibition, has reported its second quarter 2016 results. Here is some information from that statement:

Premier Exhibitions, which owns RMS TItanic Inc and Titanic:The Artifact Exhibition, has reported its second quarter 2016 results. Here is some information from that statement:

- Gross profit decreased to $1.1 million from $3.0 million in last year’s second fiscal quarter while gross margins fell to 16.1% from 36.5% in the prior year period. The decrease in gross profit is primarily due to the decrease in revenues and an increase in production and marketing expenses related to our New York City location.

- Total exhibition days decreased 28.4% to 1,076 as compared to 1,503 in the second fiscal quarter of 2015.

- Average attendance per exhibition day decreased 26.7% to 366 compared to 499 in last year’s second fiscal quarter. Average ticket prices for semi-permanent and partner presented exhibitions decreased 4.1% to $16.10 from $16.79 in the second quarter of fiscal 2015.

- Average attendance per exhibition day for semi-permanent exhibitions was 319 compared to 344 in the prior year period. Average ticket prices for semi-permanent exhibitions increased 3.7% to $22.20 from $21.40 in the second quarter of fiscal 2015.

Company president Michael Little stated that they need additional financing to keep going. “We have a working capital deficit of $1.4 million excluding the convertible debt of $13.5 million, which is included in the short term portion of note payable on the balance sheet.” Which is why they desperately want to merge with Dinoking (proxies have been mailed out for the special 29 Oct 15 meeting).

Little argues the merger will allow them to get additional capital ($5m) to fund ongoing operations and to have the company “break-even” in its operations. Otherwise he warns:

If we are unable to obtain additional financing, we will likely not be able to continue operations as they are currently anticipated or at all.

Of course there is that lawsuit out there by Mark Sellers to enforce the previous merger agreement, which could throw all plans out the window if it survives early judicial review.

Source:Premier Exhibitions Reports Second Quarter Fiscal 2016 Results(Press Release-14 Oct 2015, Global Newswire)

Premier Exhibitions Will Have Haunted Ghost Tours at Titanic: The Artifact Exhibition in Las Vegas

Every year when the calendar turns to autumn, I always look for the

first Titanic themed Halloween story. Sometimes it is stories of ghosts at Titanic exhibits or other such things. Well Premier Exhibitions has decided to capitalize on this interest by offering their own Haunted Ghost Tours at the Luxor Hotel exhibition in Las Vegas this Halloween season. According to the press release:

One of the most interesting spirit stories told is the “Lady in Black”

who is often seen on the Grand Staircase crying for her famous friend, Margaret Brown. Visitors will also get the chance to feel the presence of Frederick Fleet, Titanic’s look-out on the ill-fated night, who watches over the Exhibition’s Promenade Deck as he attempts to make up for his unfortunate late sighting of the iceberg. Additionally, guests will learn about the passenger who prophesied the sinking of the Ship of Dreams by writing to a friend just a few days before perishing in the North Atlantic, “Right now I wish the ‘Titanic’ were lying at the bottom of the ocean.

These special tours are only on Saturday nights at 8pm in October. I am surprised they will not have a special midnight tour on Halloween itself since it will be a Saturday (they will have the 8pm one though). Perhaps those ghost hunter guys will show up with those gizmos that detect ghosts to add an air of authority and perhaps a special on the History Channel (real Ghosts of Titanic!). Or just send in that poor sidekick from Muppet Labs. The last time he visited a haunted house, it was quite memorable.

Source: Experience R.M.S. Titanic’s Haunted Legacy this October with Haunted Ghost Tours at Titanic: The Artifact Exhibition (Press

release-Premiere Exhibitions, 21 Sep 2015)

Update on Premier Exhibitions and Dinoking

The South China Morning Post is reporting that Linda Ching, the daughter of Ching Mo Yeung who is accused of financial crimes by China, is no longer part of the Dinoking deal and replaced by another investor. Her investment was revealed in documents filed with the British Columbia Securities Commission and the US Securities and Exchange Commission. However Dinoking has informed Premier that the funding note involved was replaced by another investor on 6 Jul 2015.

The South China Morning Post is reporting that Linda Ching, the daughter of Ching Mo Yeung who is accused of financial crimes by China, is no longer part of the Dinoking deal and replaced by another investor. Her investment was revealed in documents filed with the British Columbia Securities Commission and the US Securities and Exchange Commission. However Dinoking has informed Premier that the funding note involved was replaced by another investor on 6 Jul 2015.

Interestingly the three members of the finance group that Dinoking put together are difficult to verify. The Post was unable to confirm one identity and two are firms in the British Virgin Islands making it impossible to learn the owners due to secrecy laws.

Okay so we have investors whose names and identities are deliberately being kept secret. And a connection to a figure seeking refugee status in Canada who the Chinese say committed financial crimes (and also being sought by Interpol as well). Does make one wonder if the motive behind the Seller’s lawsuit is buyers remorse. And this is a way to scuttle the deal. Well just a thought.

Source:Linda Ching, Daughter Of Chinese Corruption Suspect Michael Ching, Is Replaced As Investor In Titanic Firm’s Merger(11 Sep 2015,South China Morning Post)

Premier Exhibitions News:Lawsuit Could Impact Pending Merger With Dinoking

A lawsuit by Mark Sellers, former chairman of Premier Exhibitions and through Sellers Capital owns 15.4 million shares in the company, is suing George Wight Jr. and his companies, Armada Enterprises and Armada Group of Florida. In 2014, Sellers agreed to sell his majority stake in Premier for $16.2 million. Sellers alleges Wight reneged on the deal. And he also alleges Wight misled the Premier board and shareholders about the money available to complete the deal. Sellers is requesting that a federal judge force Wight to follow through with original deal terms, seeks more than $12.5 million in damages. Currently Premier is the process of merging with Dinoking Tech. Dinoking exhibits animatronic dinosaurs. The deal is yet to be approved by the shareholders (to be voted on in October) and would allow Premier to acquire all shares of Dinoking for $6.4 million and its principal shareholder, Daoping Bao, will take control of the company.

A lawsuit by Mark Sellers, former chairman of Premier Exhibitions and through Sellers Capital owns 15.4 million shares in the company, is suing George Wight Jr. and his companies, Armada Enterprises and Armada Group of Florida. In 2014, Sellers agreed to sell his majority stake in Premier for $16.2 million. Sellers alleges Wight reneged on the deal. And he also alleges Wight misled the Premier board and shareholders about the money available to complete the deal. Sellers is requesting that a federal judge force Wight to follow through with original deal terms, seeks more than $12.5 million in damages. Currently Premier is the process of merging with Dinoking Tech. Dinoking exhibits animatronic dinosaurs. The deal is yet to be approved by the shareholders (to be voted on in October) and would allow Premier to acquire all shares of Dinoking for $6.4 million and its principal shareholder, Daoping Bao, will take control of the company.

Needless to say, this is going to cause some problems for the Dinoking merger. If the lawsuit succeeds, it would force Wight to consummate the original deal with Sellers. Not that everyone is entirely convinced of the Dinoking deal. There are nagging questions about Dinoking and its capital sourcing. And Andrew Shapiro who is president of Lawndale Capital Management with a five percent stake is quoted as saying:

Similarly, if new, more skilled board and management were assembled, Lawndale might be willing to participate in a rights offering to all shareholders to raise additional equity supporting a debt refinancing that together might prove to be a superior bid to that of Dinoking and its questionable capital sourcing.

Source: HopCat owner files $12.5M lawsuit over Titanic shipwreck deal(9 Sep 2015,mlive.com)

Additional articles on Premier of note:

‘Titanic’ shareholders cast doubt over merger, stunned that Chinese corruption suspect’s teenage daughter, Linda Ching, is financier(4 Sept 2015,South China Morning Post)

Premier Exhibitions – Shareholders Stunned Over Suspected Graft(4 Sep 2015, Valuewalk)

Premier Exhibitions : releases the following response regarding a potential financier linked to Michael Ching Mo Yeung(9 Sep 2015,4-traders.com)

Hat tip to Bill Willard on alerting me to this news.

Premier Exhibitions: No Idea Why Stock Fell

Premier Exhibitions, the owner of RMS Titanic Inc and Titanic:The Artifact Exhibition, had a sudden stock drop this week. The company in an official statement says:

With regard to the recent decline in our stock price, Premier Exhibitions, Inc. (Nasdaq:PRXI) knows of no specific reason for the decline. As previously announced, the board is currently exploring all strategic and financing options. The board is currently in advanced discussions with a potential strategic partner and is considering several other financing alternatives. We expect to have more news to report in the near future.

Now it could be just a general drift of the market but this is a niche stock, one that is not traded on the big boards. The big problem the company has is that, aside from monetizing the Titanic artifacts, it has been unable to sell the collection to another buyer. The strict conditions imposed by a federal judge means the entire collection gets sold at one time. It cannot be sold in sets or individual lots. The high sale price means only the most wealthy of investors or institutions can afford to purchase. And even if a bid is finally accepted by Premier, then you head off to federal court to have the judge sign off on it. And that will not be easy. The judge will demand lots of proof you are going to maintain the collection. And the hearing will be public. Expect anti-salvors to show up to protest the sale. Not to mention petitions that seek to reopen the salvage award.

Or another reason could be the decision to have a 1 for 10 reverse stock spilt. Normally a stock split gives you stock (for every ten shares you own we give you two). Reverse stock splits are not unheard of but unusual. It is cheaper than a stock buy-back but means investors loose shares. Say you have 100 shares in Premier. Every 10 shares will be converted to 1 share. So instead of 100 shares, it gets cut to 50. In theory, by reducing the number of shares held by investors it increases the market value. Premier had 49.1 million shares before the deadline of 27 Feb 2015. Now thanks to the reverse stock split, it now has 4.9 million shares thus increasing its market value. And its ability to keep the stock price above a certain threshold ($1.00)to be publicly traded as well perhaps bettering the chances for financing.

Investors ought to be worried. They cannot sell the Titanic collection, a major deal to sell shares to another entity fell through, and there seems to be a sense that something is not going right at Premier. Taking back shares is a desperate gamble to keep the stock from sinking below $1.00. As of today, the stock is trading at $3.02. So it seems to have worked but still the stock is more trending down than up. Investors are right to be wary about this stock and perhaps take their cash out when it gets high enough to make some money. But more likely it is a loss on the tax form.

Tumult at Premier Exhibitions As Deal Goes Bust

Premier Exhibitions, which owns artifacts salvaged from RMS Titanic and operates a touring artifact exhibition, had a interesting filing with the U.S. Securities and Exchange (SEC) Commission. It announced in its 25 Nov 13D filing that current chairman Mark Sellers deal to sell his 31% share interest to Armada Group GP Inc has been canceled. The terms of the deal required that changes in the board of directors would have to take place and two would have to be independent. Since the deal is now cancelled, those changes are also voided. No word as to what happened but the filing states Sellers concluded Armada Group would not fulfill the obligations required. The filing also opens the possibility of legal action against Armada for not meeting its obligations.

What does this all mean? Speculation is the deal fell through because of some other deal that was tied to it. But that of course is just speculation. An an early deal to sell the artifacts fell through so they are trying to find ways to either sell the collection or a new way to monetize it. Shares of the company fell to 64 cents on the news.

Source:

Sellers Backs Away from Selling His Premier Stake(3 Dec 2014, The Street)

Titanic News: New Photos of Titanic’s Launch and Titanic Artifact Collection Will Now Cost More To Purchase

1. According to The Guardian, 166 photographs– never seen by the public before–are going on display at the Ulster Folk and Transport Museum. The photos show Titanic during her launch at Harland & Wolff on 31 May 1911. Images from Olympic are also included.

2. The Atlanta Business Journal is reporting a new appraisal of the Titanic artifact collection held by Premier Exhibitions is now worth $218 million. The appraisal was done by The Alasko Co. The previous appraisal set the value at $189 million. The appraisal only covers the artifacts and not any of the intellectual or archaeological assets by Premier Exhibitions.

Premier Exhibitions: NASDAQ Notifies Company They Are Not In Compliance With Requirements

NASDAQ recently sent a letter of non-compliance to Premier Exhibitions (NASDAQ:PRXI) regarding the recent director resignations. Specifically they are out of compliance with the audit committee requirements which require the audit committee be comprised of three independent directors. They have to resolve it either at the next annual shareholder’s meeting or by 27 Aug 2015. However if the annual shareholders meeting is held before 23 Feb 2015, then they must show compliance on that date. Four directors resigned on 25 Aug 2014 and were replaced by Jack H. Jacobs and Rick Kraniak on the same day.

Sources:

1. Worth Watching Stocks : Medtronic….(19 Sep 2014, Wall Street Scope)

2. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or S (16 Sep 2014, Yahoo! Finance)